Businesses operate in an environment driven by rapid digital growth, closer regulatory oversight, and more advanced financial threats; having weak internal controls is a serious and costly risk. Businesses are therefore exposed to significant fraud, such as payroll manipulation, financial statement manipulation, asset misappropriation, and expense reimbursement fraud. The financial impact of these weaknesses extends beyond direct monetary losses, including reputational damage, regulatory fines, loss of investor confidence, and disruption of daily operations.

Internal controls are a structured system that ensures accurate financial reporting, protects the business’s assets, improves operational efficiency, and enforces compliance with laws and internal policies in modern organizations, where cloud-based accounting platforms, mobile payment systems, integrated ERP solutions, and remote work models are common. A business must have control systems that must adapt to this growing operational complexity.

This article explores how organizations can reinforce their internal control frameworks to minimize various financial risks, ensure reliance on the financial statements, and comply with the law. It examines the importance of proactive oversight, the role of technology in improving internal controls, the types of internal controls, various types of workplace fraud, and the best internal control practices businesses should implement.

Understanding Internal Controls

A study by Keri (2025) defines internal controls as “the policies, procedures, and processes an entity establishes to ensure that its operations run smoothly, reliability in the financial information, and protection of their assets from misuse. These policies are built-in checks and balances that keep a business operating responsibly. They include: approval requirements for transactions, separation of responsibilities among employees, physical protection of assets, restrictions on system access, regular reconciliations, and periodic internal reviews.

The key goals of internal controls are to protect organizational assets and ensure the reliability of financial reports. For an organization to achieve this, it applies preventive controls like clear authorization procedures and access limitations. Additionally, they use detective controls, such as reconciliations and audits. Having strong internal controls in the organization ensures that transactions are recorded correctly, financial statements accurately reflect performance, and leaders make decisions based on dependable information. In this way, internal controls not only prevent financial losses but also enhance transparency, support regulatory compliance, and build confidence among stakeholders.

Types of Internal Controls

Internal controls can be categorized by how they help an organization manage risk. For instance, those used to prevent, detect, or correct fraud. Understanding these types of internal controls enables a business to develop a layered control system that reduces financial losses and operational risk. Below are the main types of internal controls, as per Kezia (2025)

- Preventive Controls

These controls enable an organization to be proactive by preventing errors, fraud, or irregularities before they occur. Their primary goal is to reduce the chances of risk occurring by building safeguards directly into processes and systems. The preventive controls include separating key responsibilities among employees, establishing approval levels for spending, using password-protected financial systems, applying multi-factor authentication for digital payments, and conducting background checks before hiring staff.

The following are examples of preventive controls:

- Access controls– restricting access to systems, data, and facilities to authorized personnel only to prevent unauthorized access, data breaches, or theft.

- Approval authorities– requiring managerial approval for transactions above a certain limit to reduce the risk of fraudulent transactions and errors in financial reporting.

- Segregation of duties– separating responsibilities for initiating, approving, and recording transactions to prevent one individual from having full control over a financial process.

- Employee training and awareness programs– educating employees about company policies and the importance of internal controls to reduce errors and policy violations.

- Physical security measures– involves using locks, surveillance systems, and security procedures to protect assets from theft or damage)

- Detective Controls

They are controls used to detect fraud and irregularities within an organization. They are mainly designed to identify errors or irregularities after they occur, but before they develop into serious financial problems. These controls provide visibility and early warning signs, enabling management to take corrective action quickly. They include bank reconciliations, physical inventory counts, internal audits, comparison of actual results against budget variance analysis, exception reports, and continuous monitoring of transactions.

The following are examples of detective controls:

- Reconciliation of records– involves comparing bank statements with accounting records to identify Inconsistencies. It helps detect errors and irregularities in financial statements.

- Internal audits– businesses should conduct periodic reviews of operations and internal controls to identify weaknesses or non-compliance.

- Exception reporting-Businesses should generate reports that highlight unusual or irregular transactions that deviate from standard patterns. This detects fraud, thus allowing more time for investigation.

- Regular inventory counts- physically counting stock and comparing it with inventory records. This should detect theft, loss, and inventory errors.

- Monitoring performance indicators– reviewing key performance metrics to detect operational inefficiencies, thus showing areas that need improvement.

- Corrective Controls

They are the controls that activate after a problem is detected. Their primary aim is to fix the issue, recover losses where possible, and prevent the same problem from happening again. They mainly include the disciplinary measures for policy violations, updating systems after identifying cybersecurity weaknesses, redesigning processes following audit findings, and adjusting approval limits after misuse is discovered.

The following are examples of corrective controls:

- Adjusting entries – making journal entries to correct errors identified during reconciliations or audits to ensure financial records are accurate and reflect the company’s accurate financial position.

- Disciplinary actions– take appropriate measures against employees who violate company policies to prevent repeated misconduct.

- Process redesign – improving procedures or control systems that have been found ineffective during reviews)

- Recovery procedures-restoring lost data or assets after a security breach, system failure, or disaster to ensure business continuity.

- Training refreshers– providing additional training to employees when control weaknesses or compliance issues are identified.

Core Components of a Strong Internal Control System

A strong internal control system is not built on isolated policies; it is structured around interrelated components that work together to manage risk and protect organizational assets. The following core components form an internal control system, as per Susan (2025)

a. Control Environment

This component forms the foundation of an organization’s internal control system. It shows the overall attitude of management and leadership toward honesty, ethics, and accountability. This includes the values of top management, the integrity of employees, the competence of staff, and the independent oversight provided by the board of directors. It also defines how authority and responsibilities are assigned within the organization. When leaders demonstrate that internal controls are important and must be followed, employees are more likely to take them seriously. Therefore, a strong control environment sets the tone for responsible behavior and proper implementation of all internal controls.

b. Risk Assessment

Risk assessment is the process of identifying and quantifying risks that may prevent an entity from achieving its goals. It involves setting clear goals, identifying potential internal and external risks, and analyzing the likelihood of each and the damage they could cause. After identifying the risks, management develops strategies to reduce or manage them. By regularly assessing risks, organizations can prepare for potential problems and minimize financial losses or operational disruptions.

c. Control Activities

Control activities are the specific rules and procedures an entity establishes to reduce identified risks and ensure that management instructions are properly followed. These activities occur at all levels of the organization and are part of daily operations. For instance, these include requiring approval before making payments, reconciling financial records, separating employee responsibilities, reviewing performance reports, and restricting access to company assets. These actions help prevent errors and fraud by ensuring that no single individual has full control over important processes.

d. Information and Communication

Information and communication refer to the systems and processes used to collect, share, and report important information within the organization. Employees need accurate and timely information perform their duties effectively and to understand their responsibilities regarding internal controls. Effective communication ensures that everyone knows company policies and procedures. Additionally, it helps the organization meet regulatory requirements and provide accurate information to investors, customers, and other external stakeholders.

e. Monitoring

Monitoring involves regularly reviewing and evaluating the effectiveness of the internal controls to ensure they continue to function properly over time. To ensure that internal controls are working effectively, businesses conduct ongoing supervision and separate evaluations, such as internal audits.

Types of Frauds in Organizations

Business fraud is a serious problem that affects organizations of all sizes. It occurs when individuals intentionally deceive a company for personal gain, resulting in financial loss, damaged reputation, and reduced trust from customers, investors, and employees. It can be committed by employees, managers, or even external parties such as suppliers. A study by Excellent Reporting (2025) highlights the following common forms of fraud in organizations.

1. Fake Vendors and Billing Schemes

Fake vendor fraud occurs when individuals create non-existent suppliers or submit false invoices to obtain payments from the business illegally. This type of fraud often occurs when approval procedures in the procurement and payment process are weak. If one person is allowed to create vendors and also approve payments, it becomes easier to manipulate the system. Businesses can prevent this:

- By verifying all new suppliers before registration

- Requiring more than one person to approve payments

- Regularly reviewing vendor records.

- Clear separation of duties and routine audits help reduce the risk of this fraud.

2. Payroll Fraud

This fraud occurs when employees manipulate salary systems for personal benefit. It commonly occurs when there are “ghost employees” within an entity who do not actually work for the company, and when overtime allowances are exaggerated. This risk is higher in organizations with many employees or branches in different locations. Without proper supervision, such fraud may continue unnoticed for a long time. Organizations can prevent payroll fraud by

- Separating payroll preparation and approval responsibilities

- Using biometric attendance systems.

- Conducting regular payroll audits to confirm that all listed employees are legitimate.

3. Expense Reimbursement Fraud

It occurs when employees submit false or exaggerated claims for business expenses. For instance, an employee may inflate travel costs, submit fake receipts, or claim personal expenses as official business costs. This type of fraud is common in organizations that lack clear expense policies or robust review procedures. To reduce this risk, businesses should:

- Establish clear written guidelines for expense claims

- require supporting documents such as receipts

- Ensure that managers carefully review all submitted claims before approval.

- Automated expense systems can also help detect unusual spending patterns.

4. Asset Misappropriation

Asset misappropriation refers to the theft or misuse of company property, including cash, inventory, equipment, or supplies. It often occurs when physical controls are weak and monitoring systems are poor. For example, employees may steal stock from a warehouse or take cash from daily sales. Businesses can prevent this by:

- restricting access to valuable assets

- conducting regular and surprise physical counts

- Reconciling records with actual inventory

- Implementing proper asset tracking systems.

5. Financial Statement Manipulation

Financial statement fraud involves intentionally misrepresenting financial information to mislead investors, regulators, or other stakeholders. This may include overstating revenue, understating expenses, improperly valuing assets, recognizing revenue too early, or hiding liabilities. Such actions are often driven by pressure to meet performance targets, secure financing, or maintain investor confidence. This fraud usually occurs at senior management levels and can lead to severe legal and reputational consequences. For an organization to prevent this, it should:

- Ensure an independent audit is conducted annually.

- Establish a strong internal control system with segregation of duties.

- Build a culture of transparency, where bad news isn’t punished but addressed.

Read Also: How Cloud Accounting Simplifies Financial Management

Essential Internal Control Practices Every Business Should Implement

Strengthening internal controls goes beyond issuing policy statements. It requires an organization to have structured and enforceable financial practices integrated into daily operations. The following practices form the foundation of an effective control environment. When consistently applied, they help reduce fraud risk, improve reporting accuracy, and enhance financial accountability.

- Segregation of Duties

Segregation of duties is one of the most effective internal control measures. It involves dividing critical financial responsibilities among multiple employees so that no single individual can control all aspects of a transaction. For instance, tasks such as authorization, record-keeping, asset custody, and reconciliation should be performed by separate employees. This separation limits opportunities for manipulation, as collusion among employees would be required to bypass the system.

- Authorization and Approval Controls

These are practices that ensure that financial transactions are executed only with proper oversight and within set limits. These controls create accountability by requiring formal approval before funds are spent or transferred. An organization with well-structured approval workflows can reduce the risk of unauthorized spending, duplicate payments, and fraudulent transactions.

Approval limits should align with organizational hierarchy. For instance, department managers may approve expenses up to a specific threshold, while higher-value transactions require executive authorization. All approvals should be documented through signed forms or system audit trails to provide clear evidence of review. In digital systems, role-based access and automated approval routing enhance compliance and traceability.

- Regular Reconciliation and Financial Reviews

Reconciliation is a key detective control that enables a business to confirm the accuracy and completeness of financial records. Regular reconciliation identifies discrepancies early, allowing management to investigate and correct errors before they result in financial loss. While you are considering reconciliation, you must include.

- Bank Reconciliation– this involves comparing internal cash records with bank statements to ensure deposits, withdrawals, and charges are accurate. This helps detect unauthorized transactions, duplicate payments, and recording errors.

- Cash Reconciliation: It is a daily and periodic comparison of physical cash with recorded balances to prevent theft or shortages in cash-heavy operations.

- Inventory Checks: It’s a periodic physical count of inventory, compared with accounting records to reveal shrinkage, theft, damage, or recording errors.

- Strong Documentation and Record-Keeping Systems

Comprehensive documentation is essential for an effective internal control system. Every financial transaction should be supported by verifiable documentation, such as invoices, receipts, contracts, approval forms, and payment confirmations. Proper documentation creates an audit trail that enables verification, accountability, and transparency.

Organized record-keeping systems ensure that financial data is accurate, accessible, and secure. Standardized filing procedures, document retention policies, and controlled system access reduce the risk of missing or altered records. Clear documentation also supports internal audits, regulatory compliance, and informed decision-making. Without reliable records, even strong control systems can fail.

Read Also: Inventory Management for Growing Businesses

How Digital Technology Strengthens Internal Controls

Modern businesses are increasingly using digital technologies to strengthen internal controls, improve accuracy, increase transparency, and manage risk. The following are the key technologies that have improved and strengthened the internal controls.

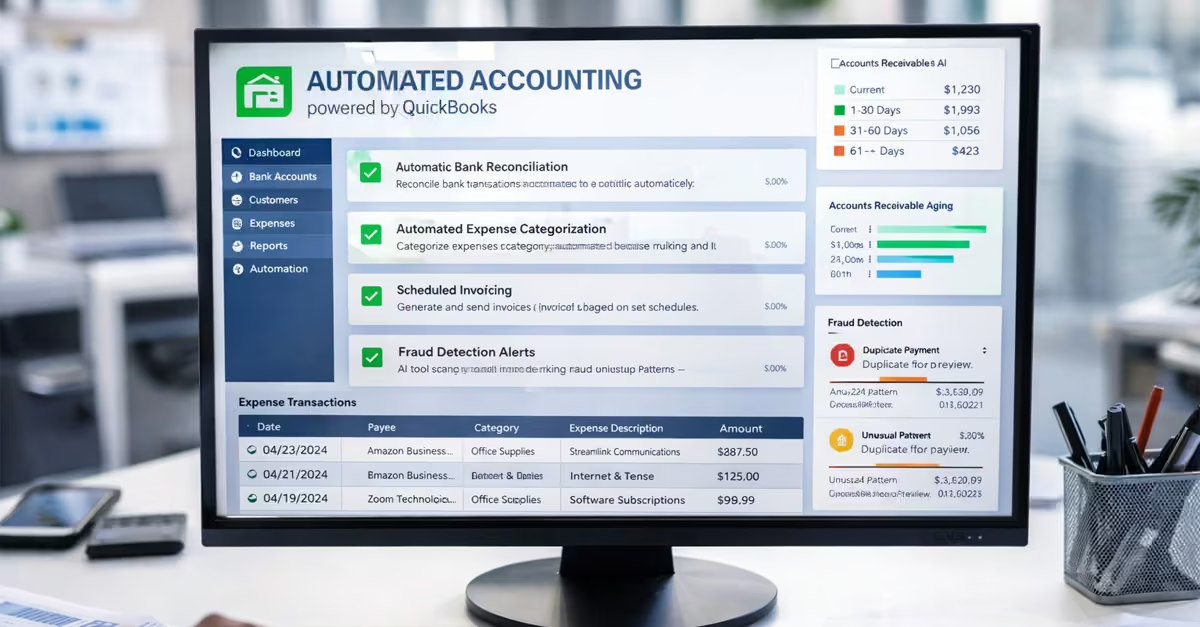

a) AI and Automation in Internal Controls

Artificial intelligence (AI) and automation have greatly improved the efficiency of internal control systems. Automated accounting processes reduce human error, ensure consistency, and help maintain compliance with financial policies. AI-powered fraud detection tools can analyze large volumes of transaction data to identify unusual patterns, anomalies, or suspicious activities. Additionally, predictive analytics further strengthens controls by spotting potential risks before they occur. Instead of reacting to financial irregularities after the fact, organizations can proactively address vulnerabilities.

b) Blockchain and Digital Audit Trails

Blockchain technology adds an immutable ledger to financial systems. Each transaction recorded on a blockchain is time-stamped and cannot be altered without detection, reducing the risk of manipulation and unauthorized changes.

Digital audit trails complement this by tracking every transaction, modification, or approval. This makes audits more efficient and reliable, strengthens accountability, and supports regulatory compliance by ensuring financial data remains accurate and verifiable.

c) Cloud-Based Control Systems

Cloud-based solutions offer secure, scalable platforms for managing internal controls. Centralizing financial data on cloud platforms improves coordination across departments and locations, especially for businesses operating in multiple regions or with remote teams.

Cloud systems also support continuous monitoring of financial activities. Managers can access dashboards and reports in real time, improving decision-making and oversight. Additionally, the scalability of cloud platforms enables internal control systems to expand as the organization grows.

d) Cybersecurity Tools Strengthening Internal Controls

Cybersecurity is essential for protecting internal controls as financial systems become increasingly digital. Using methods like multi-factor authentication limits unauthorized access to sensitive financial data. At the same time, intrusion detection systems monitor networks for suspicious activity. Integrating cybersecurity measures into internal control frameworks helps organizations safeguard financial information, reduce exposure to cyber threats, and maintain trust. Strong digital security enhances compliance and ensures the accuracy and reliability of financial reporting.

Conclusion

Strengthening internal controls is a strategic priority for businesses seeking to protect against financial losses, fraud, and operational inefficiencies. Your internal controls must include three main types: preventive, detective, and corrective measures. With strong internal controls, you will be able to detect and prevent fraud such as asset misappropriation, financial statement manipulation, payroll fraud, and expense reimbursement fraud. Finally, to achieve strong internal controls, you should implement practices such as segregation of duties, regular reconciliation of your bank statements, inventory checks, and cash balance checks. Encourage strong record-keeping and documentation, and ensure authorization and approval controls are in place.