In today’s highly competitive business environment, success doesn’t just depend on attracting new customers. Still, it depends even more on keeping the ones you already have in your business. Companies plan and perform marketing campaigns and flashy promotions often with the sole aim of drawing in new buyers. Customer retention is the quiet engine that powers long-term profitability. Loyal customers not only spend more over time, but they’re also more likely to refer others and serve as brand ambassadors. In this article, I will explore the practical, data-driven, and customer retention strategies that help a business build loyalty, reduce customer loss, and drive sustainable growth in the long run.

The Economic Retention

Customer retention is a strategic priority that drives long-term success and is also a cost-effective growth strategy. This is because a business must incur some costs, such as onboarding, marketing, and advertising, to acquire customers. On the other hand, keeping existing customers is less costly as it requires an entity to consistently provide services and communication.

A study done by Sarah (2025) shows that an entity’s profits can easily grow by 25% to 95% by increasing customer retention. This clearly shows that keeping existing customers is not just a good idea; it’s a key part of growing a successful business. Over time, businesses that focus on making their customers happy and loyal can see big results.

Retention vs. Acquisition Costs

Keeping an existing customer is much cheaper than finding a new one. A good example is given by the Army (2014), which highlights that it’s 5 to 25 times cheaper for a business to retain a customer than to acquire a new one. A business will be required to incur the acquisition costs, such as onboarding, advertisements, and promotions. Retention of a customer, on the other hand, is cheap as the entity is required just to provide excellent services that meet and exceed the customers’ satisfaction, ongoing communication, and provide periodic incentives.

This is a game-changer for SMEs with limited budgets. Instead of spending heavily on marketing to cold leads, investing in the experience of current customers offers measurable results with fewer resources.

Key Metrics to Track Customer Retention

Understanding how well your business retains customers requires tracking the correct data. By measuring key customer retention metrics, an entity gains clear insights into what’s working, what’s not, and where to improve. These numbers help you make smarter decisions, boost loyalty, and ultimately increase long-term profits. Below are the essential metrics every business should monitor to stay ahead.

A. Customer Retention Ratio (CRR)

Customer Retention Rate tells the business owner the percentage of customers who continue to do business with them over a specific period. It usually shows how well your business is keeping its customers. A high Customer Retention Rate means your customers are satisfied and loyal. It is calculated using the formula below.

CRR = (customer at end of the period- new customers acquired) / Customer at the start of the year

B. The Churn Rate

Churn Rate is the opposite of CRR. It shows the percentage of customers you lost over a certain period. A high churn rate may signal problems with customer satisfaction, service, or product quality. It is calculated using the formula below:

Churn rate= (customer lost during the period x 100%) / Total customers at the start of the year.

C. Customer Lifetime Value (CLV)

Thus, the key metric helps explain the total revenue that is expected to be generated from a single client during the entire relationship with the entity. This analysis is useful as it enables a business owner to understand the long-term value of keeping and maintaining a customer. It is calculated as explained below.

CLV = Average purchase value * purchase frequency * customer life span.

D. Customer Acquisition Costs (CAC)

This helps a business owner analyze the costs incurred in acquiring new customers. This mainly includes marketing, sales, promotion, and onboarding costs. A study done by revenue.io (2025) highlights that a business that has a customer lifetime value that is higher than the customer acquisition costs is deemed to be making more profit. This metric is calculated as per the formula below:

CAC= (total costs of sales and marketing) / (Number of new customers acquired.)

Tracking the above key metrics gives an entity a clear picture of how well it is retaining its customers and where it needs to make improvements. By understanding and acting on this data, companies can reduce churn, increase customer value, and build stronger, more profitable relationships over time.

Understanding Customer Behavior

What makes customers stay or leave?

Winning a customer is only the beginning; the real challenge is keeping them. In a market full of choices, companies that succeed in customer retention are those that understand what truly drives loyalty. Below are the factors that can make a business retain more customers.

- Consistent service – Reliability builds customer confidence and keeps them coming back.

- Emotional connections – When customers feel emotionally connected, they stay loyal beyond just price or product.

- Personalized experiences – Tailored recommendations and communication make customers feel seen and understood.

- Shared values – Customers prefer brands that reflect their beliefs, ethics, or lifestyle.

- Trust and reliability – Trustworthy brands that deliver on their promises earn long-term loyalty.

- Responsive customer support – Fast, helpful support strengthens relationships and resolves issues quickly.

- Convenient experience – A smooth, easy-to-use experience makes staying with a brand the simplest choice.

Understanding why customers walk away is just as important as knowing why they stay. Losing a customer doesn’t happen by accident; it’s usually the result of missed opportunities, broken trust, or gaps in the overall experience. By identifying the underlying reasons behind customer churn and reducing the risk of losing valuable clients, businesses can take proactive steps to strengthen relationships. Below are the reasons:

- Poor service – Slow, rude, or unhelpful service quickly drives customers away.

- Unmet expectations – When the product or experience doesn’t match what was promised, trust is broken.

- Better offers from competitors – Customers may leave if they find more value, better pricing, or improved service elsewhere.

- Lack of engagement – When customers feel ignored or forgotten, they’re more likely to lose interest and switch to a more attentive brand.

Segmentation and RFM Analysis

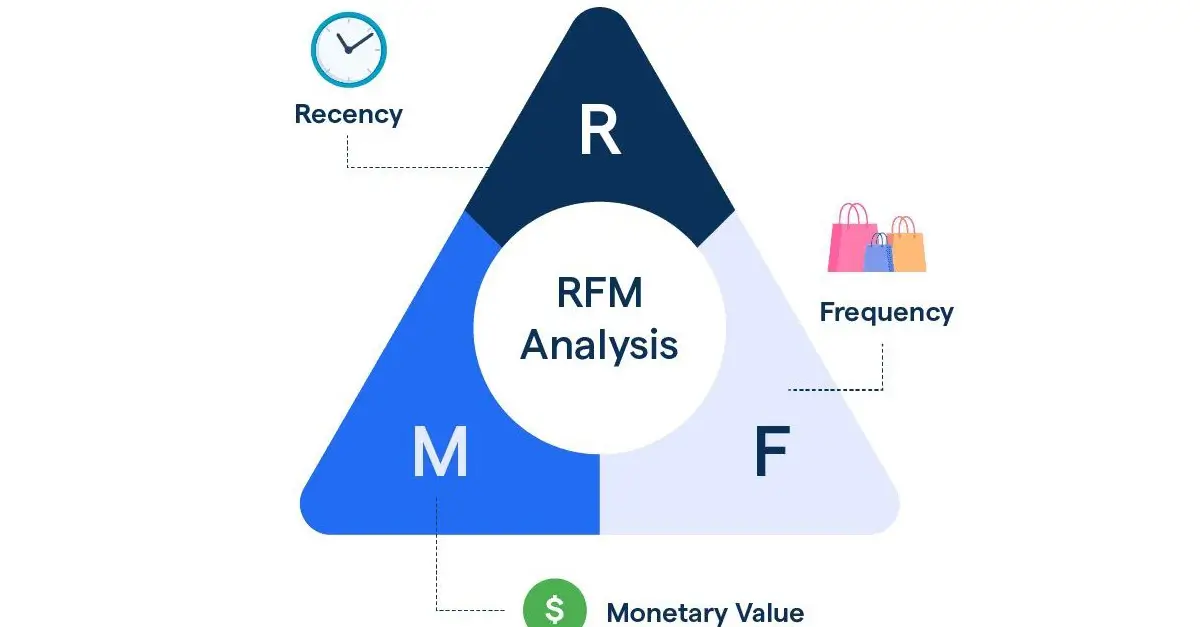

All customers are not the same, so they are not supposed to be treated the same way. Ignoring this limits a business’s efforts to retain customers. That brings in the concept of RFM analysis, which simply stands for recency, frequency, and monetary value. Businesses use this concept to categorize different customers into different groups. The RFM concept is explained below.

- Recency—How recently customers made a purchase in your business. This measures the time since a customer’s last interaction or purchase. Clients who have recently made a purchase are more likely to return than those who haven’t engaged in a while. The more recent the activity, the higher their interest or loyalty level.

- Frequency –This tracks how many times a customer has purchased within a given period. Frequent buyers are typically more loyal and engaged, making them prime candidates for rewards or exclusive offers.

- Monetary –This looks at the total amount a customer has spent over time. High spenders are usually your most valuable customers, and identifying them helps you prioritize where to invest your retention efforts.

The above approach allows businesses to create targeted strategies for each customer group. This helps an entity reward loyal, high-value customers with exclusive offers while re-engaging inactive ones through personalized follow-ups and incentives designed to win them back.

Loyalty Programs & Incentives

Loyalty programs are powerful tools for keeping customers engaged and encouraging repeat purchases. By offering meaningful rewards, businesses can turn occasional buyers into loyal brand advocates. Marco’s research (2023) presents the main types of loyalty programs and incentives a business must use to retain its customers. They are explained below.

- Point-based programs—In this type of loyalty program, with every purchase the customer makes, the customer earns a point. As these points accumulate as the customer makes frequent purchases, they are then redeemed into discounts and gifts. It’s a simple system that encourages frequent buying and keeps customers coming back.

- Tiered programs – in this model, there are levels that the customer moves up based on how much the client spends. As the customer consistently makes purchases in the business, he gets the higher tier, which is characterized by better rewards like exclusive offers, premium support, and early access to sales.

- Cashback programs – allow customers to receive a percentage of their spending back, either as cash, store credit, or future discounts. This gives an immediate sense of value and encourages more frequent purchases.

- Paid (VIP) programs—In these programs, customers pay a fee, monthly or annually, to access special benefits like faster shipping, extra discounts, or early product releases. The value they get in return often outweighs the cost, making them more committed to the brand.

Data Driven Retention

Use of Customer Relationship Management & Analytics Tools

The analytics and Customer Relationship Management tools play a key role in improving retention. Platforms like Zoho CRM, HubSpot, Mailchimp, and Google Analytics help businesses track customer behavior, preferences, and engagement over time. These tools provide valuable insights, such as when a customer is becoming inactive or when they’re likely to make another purchase, allowing businesses to take timely, personalized actions like follow-ups, special offers, or upsell opportunities.

Predictive Retention Models

Technological innovations, like machine learning, have made it possible for a business to predict which customers are most likely to leave before they actually leave. Team Base (2025) highlights that these predictive retention models analyze behavior patterns, purchase history, and engagement levels to flag at-risk customers. With this insight, businesses can take proactive steps such as sending personalized offers, targeted messages, or tailored support to re-engage customers and reduce churn before it’s too late.

Common Mistakes to Avoid

Doing the right things isn’t always the way to keep customers; it also involves avoiding the wrong ones. Minor oversights or poor habits can slowly weaken customer relationships and undo your retention efforts. By being aware of common pitfalls, businesses can maintain stronger connections and deliver a more consistent, satisfying customer experience. Below are common mistakes and entities that need to be avoided.

- Neglecting existing customers

- Inconsistent communication

- Ignoring feedback from your clients

- Overcomplicating the loyalty programs.

Conclusion

Customer retention goes beyond numbers; it reflects the entire approach an entity takes to customer relationships. When businesses commit to understanding their customers, communicating effectively, and delivering consistent value, they unlock a powerful engine for sustainable growth. Instead of focusing all your resources on acquiring new customers, take time to nurture the ones you already have. It’s a strategy that rewards you with trust, advocacy, and long-term success.

In the end, loyal customers are more than repeat buyers; they are the foundation of a resilient brand. By investing in their experience today, you secure the strength and stability of your business tomorrow.