Every shilling must count in today’s competitive market. Maximizing Return on investments is the most powerful way of doing this. Research by Aron (2023) defines Return on investments as a performance measure used to evaluate the efficiency or profitability of an investment, calculated by dividing the net profit by the cost of the investment. For small and medium-sized enterprises (SMEs), understanding and maximizing return on investments (ROI) is critical for sustainable growth, mainly when operating on limited budgets.

However, achieving high ROI doesn’t happen by chance; it’s a result of intentional, strategic budgeting. Smart budgeting allows businesses to allocate resources where they matter most, cut waste, and boost profitability. From choosing the right tools to prioritizing high-impact expenses, a well-planned budget can significantly influence your returns. In this article, we’ll explore how small businesses can apply smart budgeting principles to increase their ROI, avoid common pitfalls, and build a financially healthier enterprise.

Understanding the Return on Investments in a Small Business Context

Return on investments is more than just a financial figure in a business context; it usually reflects the overall effectiveness of how time, money, efforts, and resources have been utilized in a business. The most common form of Return on investments is financial ROI. Financial ROI mainly comprises the Return from the product launch and that of a marketing campaign. There are other types of Return on investment that a business needs to pay attention to.

- Time-based ROI—This type of Return on investment focuses on how well an entity utilizes its working hours. It entails a business investing in technological innovations that improve the overall efficiency of the production process and how fast the business offers its services to clients, such as investing in automation tools. This investment will not have an immediate impact on the organization. Still, it focuses on the long-term goals of the business.

- Resources Efficiency ROI– this type mainly measures how productive the resources of the organization will be used so that an optimal output is achieved with minimal possible waste. This ROI primarily focused on maximizing the value derived from existing inputs rather than simply increasing production or revenue. This metric evaluates whether the organization is using what it already has in an innovative, sustainable, and cost-effective manner. A business that has a higher resource efficiency ROI shows that an entity has an optimizing process, trimmed unnecessary expenses, and improved productivity without mismanaging its assets. Ultimately, it reflects the company’s ability to align its resource usage with strategic goals while maintaining operational efficiency.

Many businesses make mistakes when calculating Return on investment. One frequent error is focusing on short-term goals rather than long-term goals, like customer retention and brand reputation. Due to poor record keeping and a lack of clear objectives, many businesses fail to track their Return on investments. Additionally, some businesses overlook non-monetary returns, such as improved employee productivity and operational efficiency, which also contribute to overall success.

Principles of Smart Budgeting

Smart budgeting is the way of planning how a business apportions its resources in such a way that maximizes the outcomes and minimizes the waste. This significantly helps small businesses that have tight budgets by adopting clear budgeting principles. Below are the budgeting principles that a business can adopt to:

1. Budgeting Framework

Businesses are able to maintain and manage their finances consistently through the use of a structured budgeting framework. The use of methods like the 50/30/20 rule is one of the budgeting frameworks that a business may adopt. This framework helps a business to have a straightforward way of spending its finances. Additionally, it helps a business make decisions. It ensures that every shilling is allocated with a purpose, helping an entity stay focused and avoid unplanned costs. A study done by Eric (2024) highlights that a business needs to allocate its finances as follows:

- 50% of income is due to essential business expenses like rent, salaries, and utilities.

- 30% to growth opportunities such as marketing or training.

- 20% to savings and debt repayment.

2. Setting Realistic Goals

When financial goals are realistic and based on data, they become more effective in a business. This means that a business’s budget needs to be easily measured, like building savings, reducing costs, and increasing revenue. On the other hand, unrealistic goals can cause financial stress and disappointment. For a business to maximize its Return on investment, it needs to base its targets on actual performance and capacity rather than optimistic assumptions.

3. Prioritize Essential Over Optional Spending

Businesses must prioritize allocating their resources first to essential expenses. This cost includes stock, salaries and wages, rent, utilities, and loan repayments. When all these expenses have been settled, the remaining funds will then be directed to other non-critical expenses for a business. By adopting this operation, a company is able to continue its operations during economic downturns and prevent shortages from affecting essential areas.

4. Use the Right Tools

Modern budgeting tools make it easier for businesses to manage their finances efficiently. Tools like QuickBooks, Wave, and Zoho Books allow businesses to track expenses, compute estimates, and analyze performance in real-time. These tools help eliminate manual mistakes and provide better insights into a business’s financial condition.

5. Track and Adjust Regularly

Based on DHJ’s (2025) analysis, a budget should not be something you set once and forget. Regular reviews allow businesses to stay aligned with current financial realities. Comparing planned spending to actual results helps identify where adjustments are needed. This ongoing process ensures that the company can respond quickly to changes in income or expenses, keeping operations stable and goals achievable.

6. Plan for Emergencies

Without proper preparation, unforeseen circumstances can occur in a business, disrupting operations. Including a reserve in the business’ budget helps protect the business from financial shocks. Whether it’s a sudden drop in sales or an unplanned cost, having funds set aside ensures that the business remains resilient in the face of challenges.

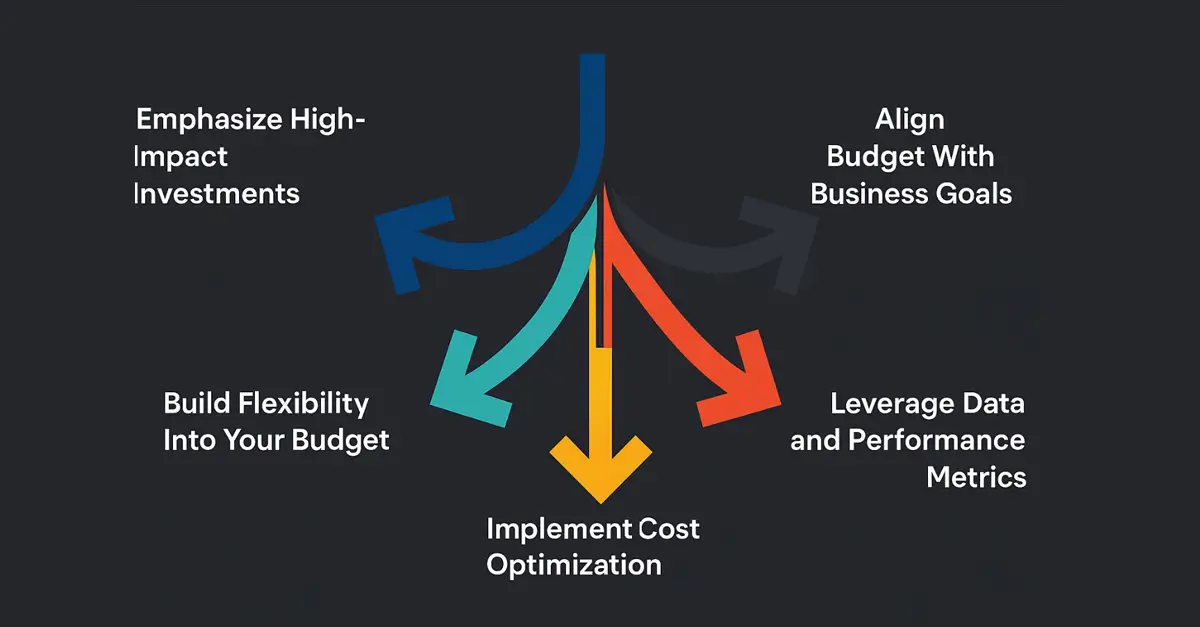

Strategies to Maximize ROI Through Budgeting

Maximizing ROI through budgeting is about more than just reducing costs. It involves a business making wise, strategic choices that lead to the highest possible Return for every shilling spent. Below are the strategies a business uses to maximize the Return on investment.

A. Emphasize High-Impact Investments

A business must focus on investing in areas that directly result in growth and an increase in revenue. A business must focus on investing in the regions that directly result in growth and an increase in revenue. For most SMEs, high-impact investments may include digital marketing, customer retention programs, or technology upgrades that streamline operations.

B. Align Budget With Business Goals

As per Notion (2024), every expense should serve a specific purpose that is aligned with the short- and long-term business goals. Suppose the goal is market expansion; budget more for outreach and advertising. If the goal is to improve service quality, invest in training or customer experience tools. A budget that doesn’t reflect the strategic direction is just a list of costs, not a growth plan. For instance, more funds should be allocated to online advertising, which might significantly boost sales if the target market is active on social media. Investing in tools like CRM software can also improve customer management, leading to better service and higher repeat business.

C. Build Flexibility Into Your Budget

Rigid budgets can break when unexpected changes occur, such as inflation, supply chain disruptions, or new customer behavior trends. Creating a flexible budget that can adjust to different business scenarios can protect the business while keeping you on track. This approach helps a business act quickly and strategically instead of reacting out of panic.

D. Leverage Data and Performance Metrics

Use past performance and real-time data to guide In budgeting decisions. Metrics such as ROI per marketing campaign, customer acquisition cost, and average order value give insights into where the money generates the best results. Tools like QuickBooks or Google Analytics can help track and visualize this data. Regular budget reviews, monthly or quarterly—allow you to adjust plans based on what’s actually working.

E. Implement Cost Optimization, Not Just Cost-Cutting

When cost is not applied without a strategy, it often harms quality or limits growth. Thus, a business should focus on cost optimization, eliminating inefficiencies while maintaining or improving the value of the goods and services produced. This can include switching to lower-cost suppliers, automating manual tasks, renegotiating contracts, or reducing energy usage. The main objective is to improve the cost-to-benefit ratio without weakening business’ operations or brand value.

Read Also: Mastering Working Capital: The Key to Operations Efficiency

Challenges

Even well-planned budgets are being disrupted by world challenges. Especially during developing economies, businesses face a lot of financial pressure, which affects their ability to achieve strong ROI and their budgeting process. A study conducted by Crimson Hawk highlights the challenges of budgeting for businesses, as discussed below.

A. Cash Flow Constraints

A lot of businesses experience inconsistent cash flows. This is whereby their revenue arrives irregularly, especially when there is a delay in payment from customers. On the other hand, expenses like rent, salaries, and even the buying of stock must be consistently paid on time. This mismatch results in a delayed purchase, missed opportunities, and inability to cover essentials. This is the main challenge because it restricts a business from making timely decisions that would lead to the improvement of ROI, such as investing in growth and taking advantage of bulk discounts.

To solve this, businesses need to adopt the measures below.

- A business should create an emergency fund to cater for unforeseen expenses or situations.

- Cash flow forecasting tools are used to analyze when there are inward and outward cash flows.

- Encourage earlier payment from customers by giving discounts for cash payments and negotiating flexible payment terms.

B. Rising Operational Costs and Inflation

The purchasing power of money erodes due to inflation. This makes the previously affordable expenses for a business expensive. From rising utility bills to higher prices for raw materials, inflation can significantly distort a business’s budget. Even when revenue increases, rising costs may cancel out gains, reducing the actual Return on investment. This makes it harder for businesses to stay on track with financial goals and long-term plans.

To address this challenge, a business needs to:

- Businesses should negotiate long contracts and bulk deals with the supplier so as to lock in prices.

- Aim to maintain a health profile margin by adjusting the prices of goods and, when possible.

- A business can eliminate unnecessary waste by conducting regular audits.

- Shift to a flexible budget that allows periodic updates to reflect current economic conditions.

C. Over-Reliance on Gut Feeling Instead of Data

Businesses make mistakes by making their decisions based on instincts rather than real data. This leads to mismanagement and resource waste. For instance, spending on marketing without measuring previous campaign performance can result in low or negative ROI. Gut feelings may be helpful, but data for informed decision-making must support them.

Solutions for this:

- A business should base its budgeting solutions on data analytics by analyzing the previous financial performance and market trends.

- Record-keeping culture and analysis should be enforced in the business to provide data that supports future budgeting decisions.

- The Return from different projects should be measured using key performance indicators.

D. Lack of Financial Skills

Not all business owners have financial skills, especially entrepreneurs. As a result of this, they mainly make their budgeting decisions based on instinct, leading to poor planning, missed opportunities, and overspending. A business might be generating revenue but still operate at a loss due to inefficient budgeting and misunderstanding of costs and returns.

Measures to Counteract the Financial Illiteracy Problem

- Offer financial literacy training to business owners and key staff members.

- Use user-friendly financial tools like QuickBooks, Wave, or budgeting templates in Excel that provide guided support.

- Consider outsourcing financial management or consulting a part-time accountant for strategic budgeting and planning.

Conclusion

Smart budgeting isn’t just about cutting costs; it’s about making every coin count. For small businesses, where margins are often tight and competition is intense, strategically budgeting can directly impact Return on investment (ROI). From choosing the right tools and prioritizing high-impact areas to tracking performance and staying responsive to market shifts, the way a business plans its finances shapes its overall success. A business needs to apply various strategies to ensure high Returns on investments, such as emphasizing high-impact investments, aligning the budget with the business goals, coming up with flexible budgets, using cost optimization techniques, and leveraging data and performance.

Despite the challenges from inflation to cash flow inconsistency, a business can easily overcome them by implementing strategies like negotiating long contracts with suppliers, encouraging customers to pay debts on time, forecasting cash flows, adjusting the prices of the product to reflect the market conditions and level of inflation, and finally leveraging data analytics during budgeting decision-making. Increase the Return on investment today by implementing the above principles.