Accessing credit in today’s world has become easier than in the past. An individual can easily access a loan by just clicking a few taps on their mobile phone, and a business can also access asset financing and bank overdraft to keep its operation going smoothly. But beneath the convenience lies a complex web of interest rates, hidden charges, and repayment obligations that determine the actual cost of borrowing. Understanding this “true cost” means recognizing that a loan is more than just the principal amount. It includes interest, fees, repayment terms, and psychological pressure, each shaping the borrower’s financial experience. For individuals and SMEs in Kenya, who often operate with tight margins or fluctuating incomes, the implications of not fully understanding these costs can be significant. Whether one is acquiring a loan for personal emergencies, starting a business venture, or expanding a business, this article will guide you and help you in understanding credit interest, its structures to the hidden fees, so as to help you make decisive and sustainable decisions while you are borrowing.

Types of Credit and their Characteristics

A. Personal Credit

Personal credit options are commonly used and broadly accessed, especially due to the increase in the use of mobile-based lending platforms. The commonly used credit loans in Kenya include credit cards, salary advances, and mobile loans like Mswari, Fuliza, and KCB M-pesa loans.

Key Features of Personal Credit

- Fast disbursement—The speed at which the funds are transferred to the borrower is the main attraction for this type of loan. Some of these personal credit products, like M-shwari and Fuliza, are available all the time; thus, one can get access to the funds at any time, making them most favorable.

- Easy accessibility—Personal credit loan products are easily acquired. In this case, minimal documentation is required for one to make an application for these loans. Additionally, one can easily apply via mobile apps.

- High interest rates and fees—The transaction fees and interest rates for this kind of loan are relatively high as they are perceived as high risk.

- No collateral is needed—in these loans, the lender does not need the borrower to pledge assets such as property as security, thus termed unsecured. This makes them more accessible to individuals who may not have traditional forms of security.

- The repayment period is usually short—These loans typically have short repayment timelines, ranging from a few days to one month. For mobile loans, repayment may be deducted automatically from the borrower’s next M-Pesa deposit or salary, reducing the need for manual follow-up.

- Credit scoring behavior is used when giving someone a loan. Instead of formal credit history, mobile lenders use alternative credit scoring methods. For example, Fuliza and M-Shwari assess a borrower’s mobile money activity. At the same time, salary advance providers evaluate monthly earnings and employment stability.

B. Business Credit

Business credit is a type of loan that offers businesses the ability to borrow money and access goods and services with the promise to pay in the future; thus, it helps an entity manage its cash flow, handle emergencies, and invest in growth. Below are the standard forms of business credits as per Lenkie (2025):

- Overdrafts—This kind of credit allows a business to withdraw more money than the amount available in the business’s account up to a certain approval point. It’s mostly favorable for covering short-term cash gaps. Interest is usually charged daily on the overdrawn amount.

- Asset Financing is mostly used when a business uses loans or leases to buy equipment, vehicles, or machinery. The asset often serves as security for the loan. It may involve upfront fees, and in some cases, the lender owns the asset until payment is complete.

- Invoice Discounting– A business borrows money against its unpaid invoices. In this case, the lender gives a percentage of the invoice value upfront, and the balance when the customer pays. This improves cash flow without waiting for customer payments.

- Revolving Credit Facilities are flexible loans that allow a business to borrow, repay, and borrow again up to a set limit. They are like credit cards for businesses. They are ideal for ongoing cash needs or irregular expenses.

Key Features of Business Loans

- They can be used for general or specific uses of the business

- Short-Term or Long-Term- Business credit can be structured for short-term needs, like overdrafts, or long-term investments, like asset financing.

- Interest Charges-Interest is charged, often on a daily, monthly, or annual basis. Rates depend on the type of credit and lender risk.

- Security or Collateral—Some business credit types require collateral, like equipment or invoices. Others may be unsecured, so no collateral is needed.

- Credit Limit- Loaners approve a maximum borrowing limit based on the business’s creditworthiness and financial performance.

- Fees & Charges: This loan may include setup fees, maintenance charges, or early repayment penalties, depending on the credit type.

Breaking Down the Interest Rates

It is essential for any borrower or business to understand how interest rates work. Interest directly affects the total cost of borrowing, and it varies based on how it is calculated. Different types of interest and repayment structures influence how much one repays over time. Below are the most common types of interest rates.

Simple Interest Rates

As per Elivis (2024) this type of interest rate calculates the original amount borrowed. The amount of interest remains the same throughout the loan period, resulting in lower overall costs compared to other methods of calculating interest rates.

Compound Interest Rates

This type of interest rate is calculated using both the principal and any other aggregated interests from previous periods, resulting in the total amount outstanding growing faster over time. In long-term loans, compound interest rates can significantly increase the total repayment amount.

Annual Percentage Rate

This type of interest rate mainly represents the annual cost of borrowing, which includes the specific fees and interest rates. It helps the borrower compare loan packages from different lenders.

Flat Rate

In this type of interest rate, the original loan amount for the entire duration of the loan is used when calculating the interest rate; thus, the interest does not decrease as the loan is repaid. This type can be attractive as there are lower monthly payments, but it often leads to high total interest payments.

Reducing Balance Rate

In this type, the remaining amount of the loan after each repayment is used to calculate the interest rate; therefore, as the principal reduces, the interest rate also reduces until the last period of the loan. This method is generally more cost-effective and results in lower total interest compared to flat rates.

Uncovering the Hidden and Extra Fees

Individuals and businesses consider interest rates when they take out a loan, not knowing that that is just one part of the total cost of the loan. Many loans have hidden fees that are not easily noticed by the applicant, making the loan later more expensive than expected. Below are the common hidden charges that a borrower needs to consider while borrowing.

- Application process charges- are charges incurred by the loan applicant at the beginning of the loan process, such as paperwork and administrative costs. These charges are never refunded, even if the loan is not approved.

- Late payment charges are the extra charges incurred when the borrower misses a repayment deadline. Especially in mobile loans, these charges accumulate quickly, leading to a burden on the borrower.

- Annual fees are mostly applicable to credit cards. They are the annual charges that a credit holder incurs for holding the account, irrespective of usage.

- Credit insurance costs—these costs are often incurred when loan protection insurance is included in the lender’s loan package. In this case, these costs increase the total sum of loan repayment and make the cost of acquiring funds expensive.

- Early payment penalties are costs incurred when the borrower pays back the loan earlier than the agreed period.

Read Also: Debt Management: How Companies Handle Borrowing

Understanding the Repayment Terms

These are terms that will determine how the borrower repays their loan, including the amount to be repaid, the duration of payments, and the frequency of payments. The terms meaningfully affect the affordability of the loan and the overall cost of borrowing. Below are the key elements to understand.

Monthly vs. Flexible Repayment

Standard monthly repayment plans- in this plan, a fixed amount of payment is required from borrowers every month. This structure provides predictability and helps in budgeting. However, it may not be ideal for borrowers with seasonal or irregular income, such as farmers or tourism-based businesses. In such cases, a borrower is advised to go for flexible repayment terms, which may allow the borrower to make diverse payment amounts in different periods, making it more convenient and suitable according to an individual’s needs. However, lenders often charge higher interest rates on flexible plans to compensate for the risk of delayed or inconsistent payments.

Loan Tenure and Cost

Loan tenure refers to the total time allowed for repayment. In this case, the size of each monthly installment is reduced when one chooses a longer loan term, making the loan appear more affordable in the short term. However, the longer the repayment period, the more interest a borrower pays overall. For instance, a three-year loan will cost more in total interest than a six-month loan, even if the loan amount is the same.

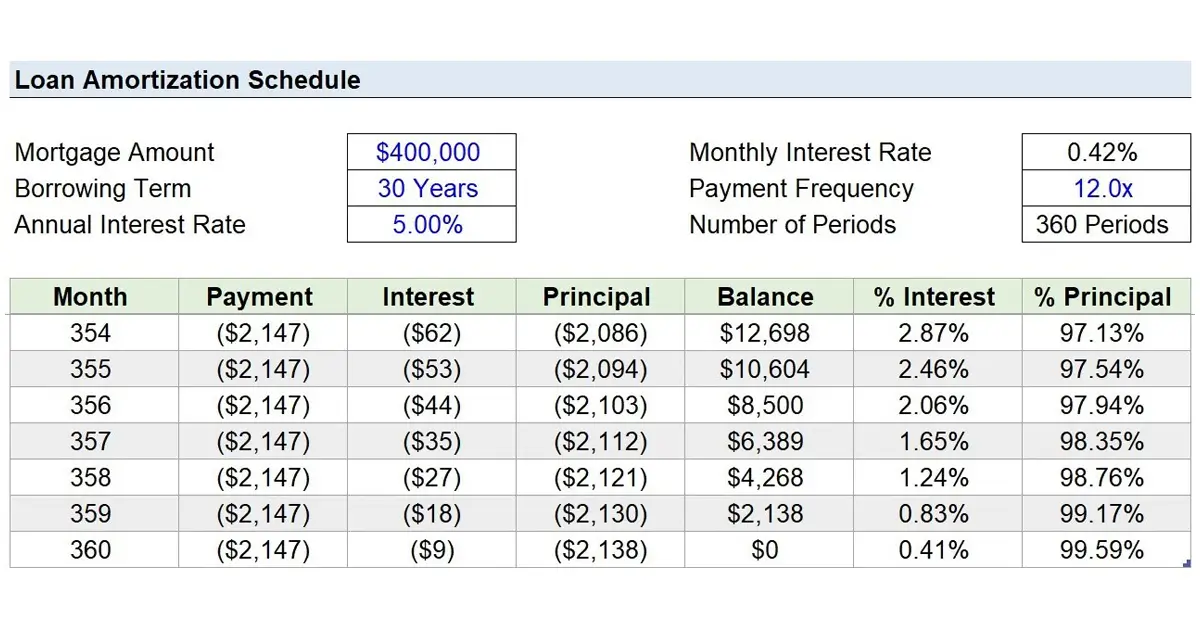

Amortization Schedules and Balloon Payments

An amortization schedule breaks down each loan payment into two parts: the portion that goes toward interest and the portion that reduces the principal. In the early stages of repayment, a larger share typically goes toward interest.

A study done by Don (2023) highlights that a balloon payment refers to a large, one-time payment due at the end of the loan term. A balloon payment keeps regular payments low but poses a significant financial risk in case the borrower is unprepared to make the final lump sum payment.

How to Evaluate the Credit Offer Before Accepting

Before taking a loan, one needs to evaluate the credit offer carefully to avoid hidden costs and unfavorable terms. This will enable an individual to know whether the particular loan is suited to their business or personal financial situation and whether it is affordable. Below are the key factors to consider.

Key Questions to Ask

- What is the APR?- one needs to be able to know the Annual percentage rate of the loan so as to understand the yearly cost of borrowing, including the interest rates.

- Are there any hidden charges? One needs to inquire whether there are extra fees such as late penalties, insurance costs, and processing charges.

- Can I repay early without penalty?-Some lenders charge fees if you settle the loan earlier than agreed, which can affect your ability to reduce interest costs.

- What happens if I miss a payment? In this case, the consequences of late payments, including penalties and added interest, need to be understood.

Responsible Credit Use Strategies

While accessing credit can support business and personal growth, it is essential to use it responsibly to avoid financial distress. Responsible credit use helps maintain good financial health, protects your credit score, and ensures long-term access to favorable loan terms. A research done by KCB bank highlights below are key strategies to guide borrowers:

- Borrow Only When Necessary-Limit borrowing to important or urgent needs. Avoid taking loans for non-essential expenses to reduce the risk of unnecessary debt.

- Avoid Stacking Loans-Do not take multiple loans at the same time or before fully repaying existing ones. Various debts can increase repayment pressure and lead to defaults.

- Monitor Your Credit History—You need to check your credit report regularly to understand your credit standing, identify any errors, and see how lenders view your borrowing behavior. In Kenya, this can be done through licensed Credit Reference Bureaus (CRBs).

- Match Loans to Income and Repayment Ability-Always assess your ability to repay based on your current and expected income. Additionally, loans that may strain your finances or lead to missed payments need to be avoided.

Conclusion

Getting a loan today is easier than before, but it’s important to know what you’re really agreeing to. Loans come with interest, fees, and repayment rules that affect your finances. Business owners or even individuals need to understand the actual cost of borrowing. For one to understand these costs, he needs to know the types of credit, how interest works, and hidden fees, which have been explained above, so as to make wise credit selection decisions that help protect both your finances and your mental well-being.