Budgeting is one of the most essential tools businesses can use to build a stable and growing business. But for many business owners, especially those handling multiple responsibilities, creating and maintaining a budget can feel difficult or even confusing. Without a clear plan for how money comes in and goes out, it’s easy to overspend, miss growth opportunities, or run into cash flow problems that hold the business back. A good budget does much more than list expenses. It gives you clarity, control, and confidence. It helps you predict future financial needs, use your resources wisely, and make decisions that support long-term success. When budgeting becomes a regular part of business management, it turns into a strategic tool rather than just another task.

In a competitive market, knowing where every shilling goes is crucial. Rising operating costs, unpredictable economic conditions, and changing customer expectations mean that businesses must be deliberate about how they manage their finances. A practical budget ensures that even during challenging periods, the business stays stable and ready for what’s ahead.

This article simplifies budgets. It illustrates what a budget is, the different techniques for building budgets, the importance of budgets in business, and clear strategies for designing an efficient budget for your business.

Understanding the Budget

Budgeting is the process of creating and managing a financial plan that outlines how much money a business expects to earn and how much it expects to spend over a specific period. For entrepreneurs, managers, and business owners, budgeting is an essential skill. It ensures that the business has the right resources to carry out projects, support operations, and achieve its goals as per Catherine (2022).

Part of understanding your budget is distinguishing between essential and non-essential spending. Essential expenses keep your business functioning, while non-essential costs can be reduced or cut if money is tight. This awareness ensures your resources are focused on the areas that matter most for growth.

A budget helps you make informed decisions, avoid financial surprises, and stay on track with both short-term and long-term goals. When you understand your budget well, you can adjust quickly, take advantage of opportunities, and maintain control over your business’s financial health.

Read Also: How to Choose the Right Accounting Software for Your Business

Budgeting Techniques Used In A Business

Every business has different goals, structures, and financial realities, which means the approach to budgeting can vary widely. Understanding the various types of budgeting helps you to choose a method that aligns with their needs. A study done by Mark (2024) highlights the following budgeting techniques.

a) Zero-Based Budgeting

Zero-based budgeting starts from scratch every budgeting period. Instead of relying on last year’s numbers, every expense must be fully justified. This method ensures that money is allocated only where it is truly needed and will create the most value, rather than continuing old spending habits.

b) Static Budgeting

A static budget is created at the beginning of the period. It remains unchanged throughout, regardless of actual changes in sales, costs, or activity levels. It works well for expenses that do not change much, such as rent, salaries, or insurance, because these costs remain stable even if business conditions shift.

c) Incremental Budgeting

With incremental budgeting, you use last year’s budget as the starting point and adjust it by adding or subtracting a fixed percentage. These changes may reflect inflation, business growth, changes in demand, or shifts in operating conditions. This method is practical and straightforward, especially for stable businesses with predictable expenses.

d) Performance-Based Budgeting

Performance-based budgeting allocates funds based on specific goals, outcomes, or performance indicators. In this method, you allocate resources to different departments in your business based on how effectively they contribute to the organization’s objectives.

e) Activity-Based Budgeting

This method focuses on the activities or tasks that drive costs within the business. Funds are allocated based on the cost of each key activity and its importance to the company’s objectives. It helps ensure resources are directed toward activities that add the most value to operations or strategy.

f) Flexible Budgeting

Flexible budgeting adjusts up or down depending on changes in business conditions such as sales volume or market demand. It is ideal for organizations operating in fast-changing or unpredictable environments. This method helps businesses stay realistic and responsive throughout the budgeting period.

The Importance of Budgeting for Businesses

A budget is more than a financial statement; it is a strategic guide that shapes the direction and long-term success of any business. Below are the benefits that a business earns if it has a budget, as per Catherine (2022)

- Helps You Plan and Prioritize: A budget allows entrepreneurs to map out expected income and expenses, making future planning much easier. With a clear picture of available funds and upcoming financial obligations, you can prioritize essential activities, allocate resources effectively, and avoid unnecessary spending.

- Improves Cash-Flow Management-Cash flow is the heartbeat of a business, and a budget helps you keep it healthy. By tracking when money enters and leaves the business, you can avoid cash shortages that interrupt daily operations. A well-prepared budget highlights slow seasons, busy periods, and upcoming financial needs, allowing you to prepare in advance and maintain stable liquidity.

- Supports Better Decision Making: Business owners constantly make decisions about hiring, expansion, investments, and cost-cutting. A budget provides the financial insight needed to make informed choices.

- Enhances Financial Discipline-Budgeting promotes accountability by helping businesses monitor how money is spent. It reveals unnecessary costs and encourages smarter spending habits. Over time, this discipline strengthens operational efficiency and keeps the business stable, even during challenging financial periods.

- Builds Credibility with Lenders and Investors-Banks, investors, and partners rely on organized financial records when evaluating a business. A well-prepared budget shows that you understand your finances and are capable of managing resources responsibly. This credibility increases your chances of securing loans and attracting investors.

Read Also: Understanding Credit Interest, Fees, and Repayment Terms

Strategies for Building an Efficient Budget

Creating your first business budget can feel overwhelming, but it’s far simpler than most business owners expect. You don’t need complex tools, just clarity, discipline, and a realistic understanding of how money moves in and out of your business.

i. Understanding Business Income and Expenses

A practical business budget starts with a clear understanding of how money enters and leaves the business. Begin by mapping all your business’s revenue streams. Don’t overlook occasional sources such as grants and interest on deposits. Where possible, diversify your revenue streams to reduce risk and stabilize cash flow across the year.

On the expense side, categorize your costs into fixed and variable. Fixed expenses are costs that remain the same over a set period of time and must be paid regularly, regardless of changes in activity or usage, while Variable expenses are costs that change over time depending on the level of output or activity. Tagging each cost as fixed or variable helps you see where you can make quick adjustments during slow periods and where bigger structural changes may be needed.

ii. Separate Personal and Business finance

Separating personal and business finances is one of the most essential habits for any entrepreneur and even a business owner. When the two are mixed, it becomes difficult to track performance accurately, and even worse, it can expose you to legal and tax complications.

You need to open a dedicated business bank account and mobile money wallet for all business income and expenses. This will enable you to gain clarity and professionalism, as Mary (2025) suggests. Additionally, you’ll be able to see precisely what your business earns and spends, making budgeting much easier and far more effective. With clean financial separation, budgeting becomes easier, audits are smoother, and your business appears far more credible to lenders and investors.

iii. Tax Planning and Compliance

Tax planning and compliance should be a proactive part of your budgeting process, not a last-minute scramble at the end of the financial period. A good rule of thumb is to set aside approximately 25–30% of your net income after business expenses for taxes. Keeping this money in a separate account can help you avoid the temptation to spend it.

Maintain a clear tax calendar that tracks all filing and payment dates for VAT, payroll taxes, corporate taxes, and any local levies. Keep all supporting documents, including sales records, input receipts, payroll data, and bank statements, well-organized to simplify audits and reconciliations. With disciplined tax planning, you reduce penalties, maintain cleaner books, and make more accurate business decisions based on after-tax realities.

iv. Leveraging Budgeting Tools and Software

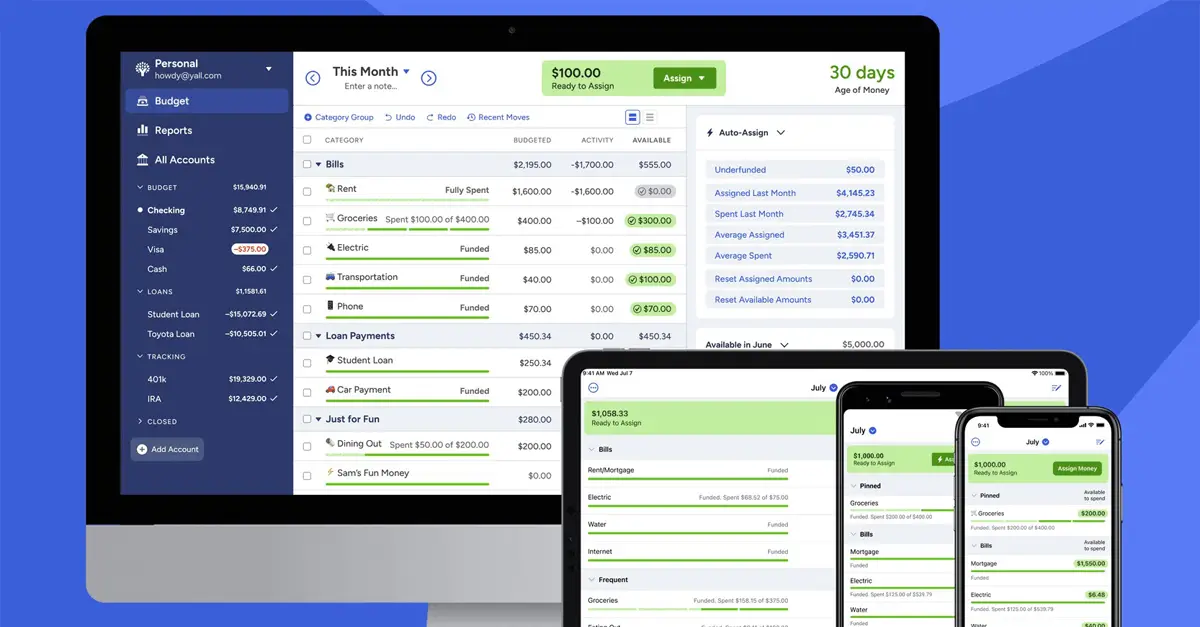

Using budgeting tools can make managing your finances far easier, more accurate, and more efficient. A study by Salim (2025) highlights that Modern apps like Mint and YNAB (You Need a Budget) automatically track your expenses, categorize transactions, and provide clear insights into your spending habits. This removes the guesswork and gives you a real-time picture of your financial health. Budgeting tools can reveal patterns you never noticed, helping you identify areas to cut back without affecting your lifestyle. This will help you keep your business accountable by showing the numbers as they change day by day. With the right tool, budgeting becomes less stressful and far more strategic.

v. Prioritize Cash Flow Management

Prioritizing cash flow management is essential because a business can show profits on paper, yet still struggle or even fail due to a lack of liquid cash. Cash flow forecasting helps you stay ahead by predicting whether you’ll have enough money to cover monthly expenses, debt payments, and payroll. It also encourages you to examine whether you can speed up customer payments, negotiate better terms with suppliers, or optimize inventory levels to avoid tying up too much capital.

By consistently tracking your inflows and outflows each month, you can spot potential shortfalls early and take corrective action. Keeping a line of credit or an emergency fund further protects your business during slow periods, ensuring operations continue smoothly even when revenue drops.

Common Budgeting Pitfalls in a Business

Common budgeting mistakes can gradually weaken a business’s financial foundation, leading to cash flow pressure, missed goals, and slowed growth. Business owners often underestimate costs and overestimate revenue, resulting in unrealistic budgets and hindering effective decision-making. By recognizing these frequent errors, business owners can craft more accurate budgets and allocate resources wisely. Below are the common mistakes.

- Underestimating variable costs-Variable costs like raw materials, shipping, or commissions can fluctuate significantly. To avoid surprises, track these cost drivers weekly and build contingency amounts into your budget so you’re prepared for higher-than-expected expenses.

- Ignoring payment timing-Revenue and expenses don’t always align perfectly with invoices or accounting periods. Budget on a cash basis for short-term planning to ensure you have enough liquidity to cover obligations. Accrual-based reports can still be used for performance analysis, but they shouldn’t replace cash-focused planning.

- Single-channel dependency-Relying too heavily on one sales channel or supplier can expose your business to unnecessary risk. Diversify both revenue streams and procurement sources to reduce the impact of disruptions or market changes.

- Set-and-forget budgets-Budgets are not meant to be static. Adapt to changing forecasts and reviewing your budget monthly allows you to adjust assumptions, respond to changes, and stay aligned with actual performance.

- Owner withdrawals bypassing budgets-Unplanned and excessive owner draws can strain cash flow and undermine the budget. You are advised to set a fixed, reasonable draw and stick to it.

Conclusion

Budgeting is more than a financial task, it’s a strategic habit that strengthens the stability and direction of any business. To make a budget for your business, you use techniques such as zero-based budgeting, performance-based budgeting, static budgeting, flexible budgeting, and activity-based budgeting. Having an adequate budget in your business will help you maintain financial discipline, manage cash flows effectively, build credibility, and provide a basis for your decisions. To create an adequate budget for your business, you need to fully understand your cash flows and expenses, maintain a separate account for your personal and business income, plan for tax payments in advance, and leverage budgeting tools. Many businesses make mistakes when preparing their budgets, undermining budget effectiveness and causing financial strain. While preparing your budgets, avoid errors such as understating your variable costs, failing to diversify your income, over-withdrawing from your business beyond budget, and setting unrealistic budgets. With good budgeting habits, your business can grow stronger and run more smoothly.